Page 23 - Libro Memoria Cien Inglés

P. 23

2.2 Management of financial The annual accounts are prepared

and economic resources from the accounting records of

the Entity, having applied the legal

The CIEN Foundation is funded provisions in force in accounting

by specific subsidies granted by matters in order to show the true

the State and other local or insti- image of the assets, the financial

tutional public entities, as well as situation and the results of the

by income derived from European CIEN Foundation.

and national research projects,

contracts for the provision of servi-

ces and patronage activities.

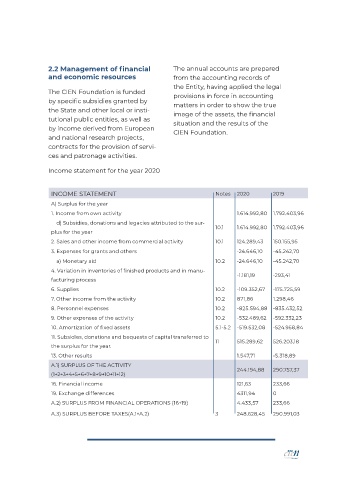

Income statement for the year 2020

INCOME STATEMENT Notes 2020 2019

A) Surplus for the year

1. Income from own activity 1.614.992,80 1.792.403,96

d) Subsidies, donations and legacies attributed to the sur-

10.1 1.614.992,80 1.792.403,96

plus for the year

2. Sales and other income from commercial activity 10.1 124.289,43 150.155,95

3. Expenses for grants and others -24.646,10 -45.242,70

a) Monetary aid 10.2 -24.646,10 -45.242,70

4. Variation in inventories of finished products and in manu- -1.181,19 -293,41

facturing process

6. Supplies 10.2 -109.352,67 -175.725,59

7. Other income from the activity 10.2 871,86 1.298,46

8. Personnel expenses 10.2 -825.594,88 -835.432,52

9. Other expenses of the activity 10.2 -532.489,62 -592.332,23

10. Amortization of fixed assets 5.1-5.2 -519.532,08 -524.958,84

11. Subsidies, donations and bequests of capital transferred to

11 515.289,62 526.203,18

the surplus for the year.

13. Other results 1.547,71 -5.318,89

A.1) SURPLUS OF THE ACTIVITY

244.194,88 290.757,37

(1+2+3+4+5+6+7+8+9+10+11+12)

16. Financial income 121,63 233,66

19. Exchange differences 4311,94 0

A.2) SURPLUS FROM FINANCIAL OPERATIONS (16+19) 4.433,57 233,66

A.3) SURPLUS BEFORE TAXES(A.1+A.2) 3 248.628,45 290.991,03